The outside sales employee exemption applies to those whose primary duty is to make sales or obtain orders or contracts outside of their place of business.

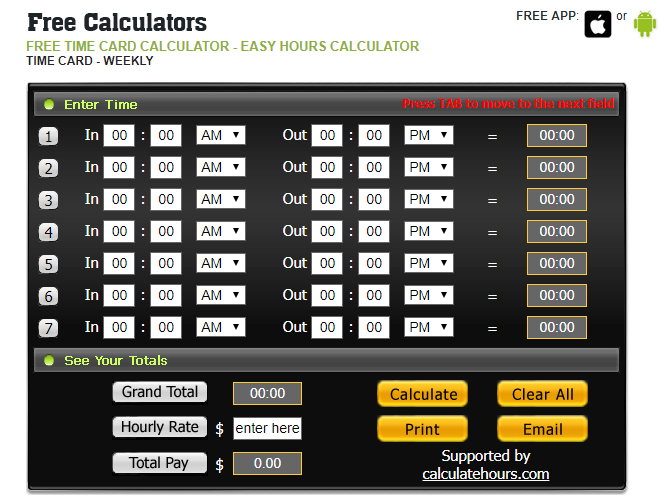

#TIME CARD CALCULATOR SOFTWARE#

This includes computer system analysts, programmers, and software engineers. The computer employee exemption applies to those who earn a minimum of $684 in salary, or are compensated at a rate of $27.63 per hour. Some other common exemptions exist, including exemptions for computer employees and outside sales employees. Some professions that fit within these categories include lawyers, physicians, teachers, architects, registered nurses, writers, journalists, actors, and musicians. The creative professional's work must require invention, imagination, originality, or talent in a recognized artistic or creative field.

In the case of a learned professional, the employee must primarily perform work that requires advanced knowledge, defined as work that is predominantly intellectual in character in the fields of science or learning. This exemption includes both "learned professionals" as well as "creative professionals." In both cases, the $684 minimum salary must still be met. This includes roles such as human resource staff, public relations, payroll, and accounting. Among other requirements, these employees must also perform non-manual office work directly related to management or general business operations to qualify for the administrative employee exemption.

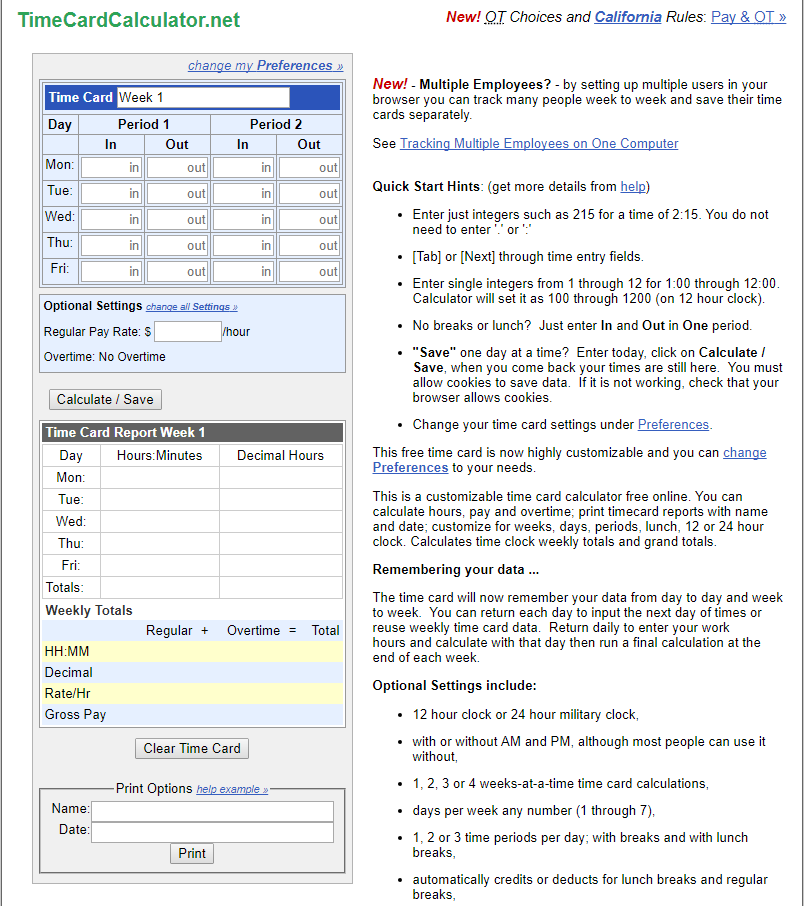

#TIME CARD CALCULATOR PROFESSIONAL#

Like executive and professional exemptions, administrative exemption still requires an employee to earn a minimum salary of $684 per week. The employee must also supervise at least two other employees and have primary duties involving some level of control over the hiring and firing process of other employees. On top of needing to meet the requirement of earning a minimum salary of $684 per week, employees that qualify for the executive employee exemption must perform executive duties such as managing the enterprise as a whole or a department or subdivision within the enterprise. Department of Labor, but below is a brief summary of the three main categories of exempt job duties. Further detail is available through the U.S. The employee performs exempt job duties (discussed below)Įxempt job duties are categorized mainly as executive, professional, and administrative job duties.The employee is paid on a salary rather than an hourly basis.The employee is paid at least $35,568 per year ($684 per week).

For most professions, if an employee meets the following three rules, the employee is an exempt employee: Department of Labor resources for a list of typical exemptions, but note that the list is not necessarily exhaustive. Certain job types are exempt by definition, including commissioned sales employees, computer professionals, farm workers, drivers, salesmen, seasonal workers, and those performing executive, administrative, or professional roles. Most workers that are paid an hourly wage fall under this category.Įxempt employees are those that are not protected by the FLSA and are not entitled to overtime pay. A non-exempt employee that is not paid overtime wages can file an FLSA overtime claim through the U.S. Employers are also required to pay these workers an overtime rate of 1.5 times their standard rate when they work more than 40 hours per workweek. Non-exempt employees are employees that are entitled to minimum wage as well as overtime pay under the FLSA. As such, it is important both as an employer and as an employee to understand one's position. In addition, many states also have wage and hour laws. Most workers are classified as either exempt or non-exempt employees, and are protected by a number of requirements placed by the Fair Labor Standards Act (FLSA). There are also regulations surrounding what constitutes hours worked, as well as regulations governing recordkeeping and child labor. Non-exempt employees (see below) that are covered by the FLSA are also entitled to an overtime rate at least 1.5 times that of their standard rate for hours worked over 40 hours per workweek (defined as any fixed and regularly recurring period of 168 hours). Most states in the United States have a minimum wage higher than $7.25. In cases where the state in which the employee works also has a minimum wage, the employee is entitled to the higher of the two wages. Under the Fair Labor Standards Act (FLSA), the federal minimum wage is $7.25 per hour as of Jan.

0 kommentar(er)

0 kommentar(er)